Explanation of Negative Charges in D365 Finance and Operations:

Add Negative CVharges D365 Finance And Operations:

D365 Finance And Operations, For enterprise resource planning, this is an era of rapid change and one of the companies that offer very solid platforms for bettering financial management and operational effectiveness is Microsoft Dynamics 365 Finance and Operations, D365 F&O. One of the major functions of D365 F&O is managing various kinds of transactions in which negative charges can be accounted for. This article explains what negative charges are, how they function within D365 F&O, and what this entails in terms of implications for businesses.

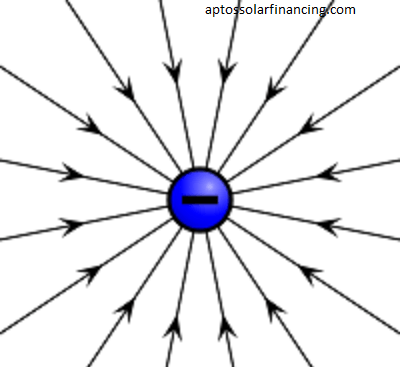

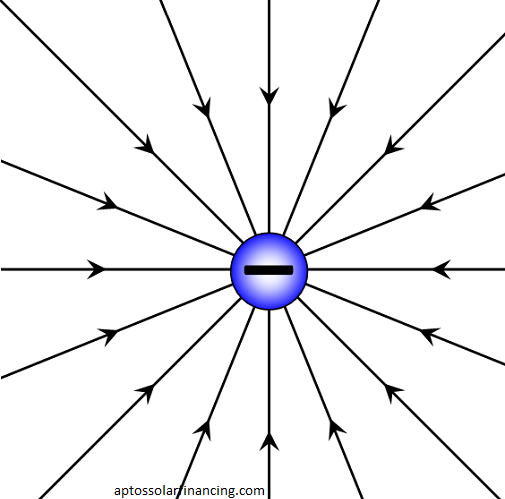

What Are Negative Charges?

Add Negative CVharges D365 Finance And Operations:

- Negative charges, as by an accounting definition, are debits totaling in reducing the overall number of receivables or generating overall revenues. They mostly result from a refund, discount of the original recorded transaction, correction, or adjustment from any past posted transaction. In D365 F&O, efficient management of negative charges is essential for correct financial records and adherence to set standards of accounting.

Mutual Scenarios for Negative Charges

Refunds: If a customer returns a product or service, the company may refund the money. This is a negative charge for the company as revenue; it must be recorded. - Discounts and Allowances: Businesses make huge discounts for prompt payments or promotions. Such discounts also can be recorded as negative charges to account for the lower revenue.

- Corrections: Mistakes during invoicing or data entry lead to errors that need to be corrected. Negative charges could therefore correct these errors so that financial accounts are correct.

- Adjusting Entries: Sometimes, changes occur and businesses have to adjust either price or accounting policies. Negative charges will always assist in this kind of adjustment.

Role of D365 F&O: D365 F&O assists in controlling negative charges the right way:

Add Negative CVharges D365 Finance And Operations:

Microsoft Dynamics 365 Finance and Operations is end-architected with features to make the management of negative charges easy. Here’s how to do it:

1. Entry of transactions:

Add Negative CVharges D365 Finance And Operations:

D365 F&O allows entry of transactions including negative charges using modules such as Accounts Receivable, Accounts Payable, and General Ledger. Each module has particular functions and powers for the recording, management, and reporting of these charges.

Accounts Receivable Module:

In the Accounts Receivable module, users feel comfortable processing customer refunds or discounts. The system automatically computes the outstanding balance of the customer once a negative charge entry is created to adjust the books of accounts.

Accounts Payable Module:

For vendors, the Accounts Payable module permits users to input negative charges that involve overpayments as well as returned goods. This module ensures that the liabilities in the company’s financial statements are correctly accounted for.

2. Automated Workflows:

Add Negative CVharges D365 Finance And Operations:

D365 F&O provides automated workflows that can easily be configured for handling negative charges. For instance, if a refund is done, the system executes a workflow including all the necessary approvals so that every transaction is scrutinized and verified thoroughly before posting.

3. Reporting and Analytics:

Another good feature of D365 F&O is that it comes with strong reporting capabilities. It should be able to give reports with specific filters on negative charges and so report on trends such as refund rates or discount levels. Such details may make a business more competitive in decision-making about pricing policies, customer service standards, and handling inventory levels.

4. Integration with Other Modules:

Add Negative CVharges D365 Finance And Operations:

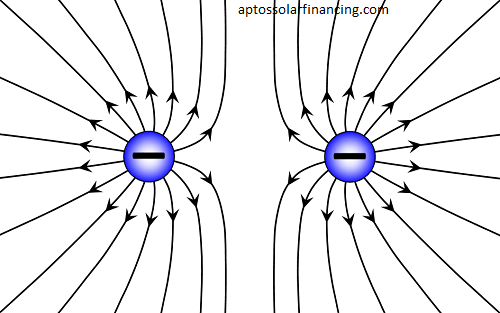

Negative charges can impact everything from inventory to cash flow. Because D365 F&O integrates perfectly across modules, negative charges recorded in one area will begin to flow into related modules automatically. So, for example, a refund done through Accounts Receivable will affect the level of inventory in the Inventory Management module.

Best Practices for Managing Negative Charges:

Add Negative CVharges D365 Finance And Operations:

To address the negative charges in D365 F&O, remember the following best practices:

1. Keeping Proper Data:

Accurate input data is an integral part of processing negative charges. Organizations must conduct a standardized procedure for recording the transaction to minimize some errors and maintain uniformity.

2. Approvals End:

Implementation of approval workflows on the negative charges in organizations will ensure no alterations occur without authorization. This averts unauthorized changes and ensures all transactions are approved before the post.

3. Periodic Reconciliation:

Such accounts must be reconciled from time to time to help identify errors regarding the negative charges. Regular analysis of financial statements helps in the detection of long-term mistakes and preserves the accuracy of business data.

4. Education and Sensitization:

Educate employees on how to manage the negative charges in D365 F&O. Developing such education will help better internalize the negative charges so that employees embrace accounting practices more effectively.

5. Leverage on Report Tools:

Ensure complete leveraging of the report tools of D365 F&O on the negative charges. Analysis of the reports leads to tracking trends and potential improvement areas hence improving decision making in financial activities.

Negative Charges to Businesses:

Add Negative CVharges D365 Finance And Operations:

In D365 F&O, the effective handling of the negativeness of charges benefits a business in many ways:

1. Cash Flow Management:

The cash flow is the most direct impact of negative charges. The settlement of refund and adjustment transactions ensures that the company has an accurate cash flow forecast; therefore, it might better plan its finances.

2. Customer Satisfaction:

Negative charges like refunds can be a major aspect related to customer satisfaction. Fast and accurate processing builds trust and assures customers that they will go back to doing business with the company in question.

3. Financial Accuracy and Compliance:

Proper management of negative charges is very important to comply with accounting rules and regulations. Incorrect entries of such charges often lead to huge differences in the monetary accounts and can lead to serious legal problems as well.

4. Operational Efficiency:

Operational efficiency is another important aspect that constitutes a part of effective negative charge management. Using workflow automation and integrated operations, businesses can avoid more administrative workloads and go ahead and do strategic ones.