How does an annual operating plan (AOP) help a startup that is growing?

operating:

Once a firm has progressed past the initial stage of determining product-market fit. The focus shifts from choosing the ideal product to guaranteeing long-term success. Startups prioritize agility and adaptability to achieve growth, operating in a fast-paced and dynamic environment.

- Realizing this, a lot of founders try to accomplish their objectives without having a well-defined operating plan.

- Mysa recognizes this viewpoint, but we are adamant that an annual operating plan (AOP). Which is a vital instrument for attaining sustainable growth and efficient financial planning, should be adopted and tailored to early-stage requirements.

Complete Form, Meaning, and Definition of AOP:

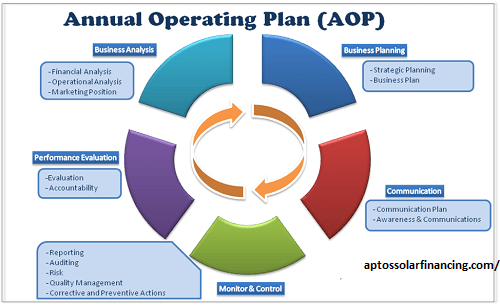

The Annual Operating Plan serves as a strategic roadmap that translates your company’s objectives into doable tasks. It outlines the monthly checkpoints required to meet the year’s specified operational goals. This procedure successfully closes the gap between the long-term goal and the immediate implementation bringing financial planning components into the mix to guarantee a well-rounded strategy.

Consider it in this manner:

- Starting a firm without first creating an annual operating plan (AOP) is like driving a car without a map or destination.

- Even if there might be some interesting side trips, there is a far lower chance of achieving your intended result.

- An AOP directs your path to success by acting as a navigational aid.

Check out our most recent post on AOP Planning for Startups:

operating:

- For startups, an Annual Operating Plan (AOP) removes uncertainty by offering a defined course of action.

- It provides specific goals and benchmarks to make sure that everyone in the company is on the same page and working toward the same end goal.

- This strategic operating plan encourages a coordinated effort to meet the objectives of the business.

An annual operating plan’s advantages:

operating:

- For startups, planning is an extremely valuable process in and of itself.

- Developing an Annual Operating Plan (AOP) forces you to identify your primary goals and foresee any obstacles.

- By providing a disciplined framework for well-informed decision-making and incorporating financial planning throughout the fiscal year, this introspective process creates the foundation for success.

- Strategic Alignment: An AOP, which expresses an effective financial planning strategy, provides a broad plan of action for accomplishing annual objectives.

- This provides a strong basis for growth by ensuring that operating and financial objectives are aligned and boosting investor confidence.

Distribution of Resources and Financial Self-Control: Knowing your plan makes it possible to allocate funds precisely, anticipate future income, costs, and cash flows, and set reasonable financial goals. - It takes intelligent financial planning to navigate the challenges of corporate expansion. Assessment of Performance: Startups can benchmark performance all year long by setting up financial and non-financial KPIs with the help of an AOP.

- It is possible to identify areas for improvement and put corrective measures in place through the process of performance tracking and operational metrics review.

AOP drafting procedure & Synopsis:

operating:

- This is a simple, yet comprehensive method to writing an AOP.

- The business head (CEO/Founder) and the finance head (CFO, Finance Manager, Head of Treasury, etc.) usually lead this process.

- Setting yearly objectives, assessing the resources that are at hand (people, equipment, capital, marketing expenditures, etc.), and figuring out the required budgeting procedure are all part of this cooperative endeavor.

- To accomplish these objectives, department heads create KPIs and plans, which lead to the approval of departmental budgets by finance teams for a unified budget.

What details ought to be in an annual operating plan?

The following needs to be included in an annual operational plan:

- Goals

- KPIs about the goals

- Resources needed

Schedules

Plans for Performance Monitoring:

AOPs are vital for businesses, but determining the KPIs that should be included—which are critical to an AOP’s efficacy—can be difficult for entrepreneurs. To ensure the success of your AOP, you must adhere to particular standards and have an organized set of key performance indicators.

The S.M.A.R.T. Framework for KPI establishment:

operating:

- Now that the objective has been established, what KPIs should the different departments within your startup set, and how should they choose them? Setting SMART goals for your Key Performance Indicators is the foundation of a strong yearly operational plan (KPIs). SMART stands for Time-Bound, Specific, Measurable, Achievable, and Relevant. You can make sure your objectives are precise, doable, and completely in line with your main operational plan goals by creating them inside this framework.

- With this clarity, you can monitor your progress throughout the year in an efficient manner.

- Everyone in your organization is aware of the goals and can work toward them under the direction of the yearly operating plan.

- For example: If your goal is to raise revenue by 10%, using a SMART method in your annual operational plan could result in increased sales of 5% in the first quarter, 3% in the second, and 2% growth in the third and fourth quarters.

- This breakdown makes scenario preparation easier by breaking things down into smaller, quantifiable milestones that can be monitored and changed as necessary.

SMART goals are essentially the road plan for reaching your targeted KPIs:

Important Performance Measures to Add to the AOP of Your Startup:

Now, while each business has its own set of KPIs to include in its yearly operational plan, all startups should have certain line items in their plan. Your business stage determines what you put in those line items. However, in general, the following categories should be covered by the KPIs:

- KPIs for marketing

- Sales KPIs; Human Resources KPIs

- KPIs for IT Operations and Customer Service

monetary measurements - A key element of financial planning is monitoring the performance of your business in these areas, which requires the creation of multiple dashboards covering each of these financial parameters.

1. Marketing KPIs To assist you in gauging the success of your marketing campaigns and streamlining your financial budgeting within the yearly operating plan, the following is a summary of key marketing performance indicators (KPIs) for startup owners.

Cost-Effectiveness:

operating:

1. Cost per Click (CPC): This figure shows you how much each time a user clicks on your advertisement, you have to spend. Effective ad targeting is shown by a decreased CPC.

CPC = Total number of clicks / Dollars spent on the ad campaign

Seek a CPC that is in line with both your spending plan and industry norms. Examine clicks to determine whether they result in leads or sales. Low conversions coupled with a high click-through rate (CTR) could be a sign of a targeting problem.

2. Cost per Acquisition (CPA/CAC): This gauges the entire expense, including marketing spend, associated with bringing on a new client. More effective client acquisition techniques are indicated by a lower CPA.

CPA/CAC = Cost of advertising campaign / Total number of new clients:

Monitor your CPA over time to determine whether gaining valuable clients is more cost-effective for your marketing efforts. Examine your marketing channels to determine which ones provide more revenue at a lesser expense.

Revenue Generation 1. Return on Advertising Spend (ROAS):

This Key Performance Indicator (KPI) indicates the amount of revenue generated for each dollar invested in advertising. An excellent return on your marketing expenditure is indicated by a high ROAS.

Revenue / Advertising Expense = ROAS:

operating:

You can determine the most profitable advertising channels and adjust your budget accordingly by monitoring the advertising revenue per campaign. Aim for a positive return on assets (ROAS) consistent with the profit margin. You may need to optimize your pricing strategy or your ads if your ad revenue is negative. Payback period: Measures how long it takes to recoup the costs of attracting a new customer. Customer acquisition speed:

1. A faster repayment period means a more efficient customer acquisition strategy. A long payback period can be a sign of low customer lifetime value or high customer acquisition costs. Explore both sides to get the most out of your plan. Think about improving customer lifetime value with better retention tactics or lowering CAC with more targeted marketing.

Impact of marketing Percentage of customers originating from marketing:

This figure shows the proportion of new customers you add directly as a result of your marketing efforts. A high ratio shows how well your marketing is generating revenue. The percentage of customers from marketing is calculated by dividing the total number of customers by 100. To determine the contribution of marketing, compare this figure with other customer acquisition methods (such as sales). Your marketing efforts work if the percentage of customers coming from marketing increases. Also, consider financing channels that provide a large portion of valuable customers.