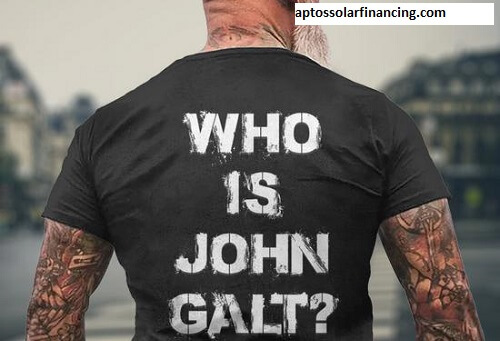

Who is John Galt Finance?

“You who question, you who question everything, you who doubt, you who are untrustworthy, you who question, who are you?” This is the first line of the question “Who is John Galt?”, which has its origins in Ayn Rand’s fictional novel Atlas Shrugged, which has recently become a symbolic phrase in modern debates, especially in philosophy, economics, and finance.

John Galt, according to the novel, is an idealist of individualism, rationality, and self-reliance. His question designates the streak of excellence, independence, and nonconformity.

A reflection of these values are the pages of John Galt Finance. A company that tells us it is a visionary and principled financial services company dedicated to achieving customer success through innovation and integrity.

In this article, we delve deeper into the mission and values of John Galt Finance, exploring how it fits into the larger financial landscape. To give you a head start, we have some frequently asked questions about the company.

The Philosophy Behind John Galt Finance:

Understanding John Galt’s Finances requires an exploration of the principles that the company represents. As if the name itself was not paradigmatic of any lesson from Atlas Shrugged. John Galt is a man who leads a rebellion of industrialists, inventors, and artists who refuse to be exploited by a society that thrives on dependency.

He is the epitome of a man who aspires for self-interest and selfishness, but practicality or individual rational pursuit for success.

This philosophy is portrayed by John Galt Finance in values about innovation, personal responsibility, and the growth of an individual.

Its core basis is the philosophy of Ayn Rand’s Objectivism: reason, purpose, and self-esteem. Essentially, these principles suggest that financial independence, wealth creation, and personal growth need a rational basis behind self-discipline and innovation.

John Galt Finance provides clients with various financial services that can help them organize their finances. The firm’s commitment to technology, personalized strategy, and ethical practices could make the company provide more than a unique approach to wealth management and investment strategy that offers financial education.

Some of the crucial services offered by John Galt Finance include:

John Galt Finance is a package service meant to cater to the changing wants of individuals, organizations, and businesses. Some of them include;

1. Wealth Management:

John Galt Finance is a wealth management company focused on individualized approaches to building, preserving, and transferring wealth for clients.

Its concentration is on long-term financial planning through investment techniques adapted to the goals. Risk threshold, and prevailing market conditions of its clients. Its services include asset allocation, retirement planning, estate planning, and tax-efficient investing.

2. Investment Advisory:

They help clients maximize returns on investment while keeping risk manageable in this advisory service by the company. Advisors at John Galt Finance keep abreast of market trends, macroeconomic factors, and client-specific needs to create customized portfolios.

From the most elementary stock to a bond or mutual fund to other alternative investments, data-driven techniques ensure that such outcomes for the firm would be its best.

3. Retirement Planning:

Retirement planning is one of the significant services provided by John Galt Finance. The company takes its clients through the complexities of retirement through such planning that focuses on financial independence in retirement.

It includes setting up 401(k)s. IRAs, Roth IRAs, and other retirement accounts, and advising clients on withdrawal strategies and Social Security benefits.

4. Financial Education:

John Galt Finance believes in financial empowerment through education. The firm presents seminars, workshops, and online courses across various fields such as investing, budgeting, financial planning, and economic literacy. In so doing, the firm urges people to take care of their financial lives with greater confidence and clarity.

5. Corporate Services:

For corporations, financial planning services include business valuation, tax planning, and financial forecasting. All these are structured in a way that helps corporations maximize growth while minimizing the risks involved in their overall financial strategies.

The company also offers employee benefit consulting through assisting businesses in designing and managing their employee retirement and insurance plans.

How John Galt Finance Differentiates Itself:

John Galt Finance differs from all the other financial firms since self-reliance and individualism have been included as a model for a business. The company uniquely differs in the finance world in the following ways:

1. Client-centered approach:

While most financial firms have a one-size-fits-all approach toward wealth management and investing, John Galt Finance believes in being highly customized. Every client is unique with different financial goals, risk tolerances, and investment preferences. As such, the firm tailors strategies to meet each client’s specific needs so that its clients can amass wealth based on their terms.

2. Focus on Innovation:

This finance company is committed to staying ahead of its time by adopting the latest available high-tech to incorporate into its financial planning. Through employing advanced data analytics, artificial intelligence, and algorithmic trading, the firm strengthens portfolio management and in turn performance of investments. With these tools, the company can offer solutions that are more accurate, efficient, and innovative.

3. Ethical and Transparent Practices:

An Industry That Can Sometimes Be Obvious: John Galt Finance is an entity that claims to be very transparent and honest in all engagements. This provides clients with high levels of visibility around their financial plans and portfolios, including clear explanations of all the strategies and fees. The commitment of the firm to ethical practices is what leads the way to long periods of always putting one’s client’s interests first.

4. Focus on Long Term Success:

Long-term financial success is at the forefront rather than a short-term gain, thanks to John Galt Finance. For the company, growth needs to be done sustainably. They encourage their clients to save, invest, and manage wealth with discipline. They help their clients bring out everlasting financial independence by focusing on long-term goals.

5. Objectivist Principles:

Unlike other companies, the company hails from Ayn Rand’s philosophy called Objectivism. The firm believes in rational self-interest, personal responsibility, and individual liberty, which lends quite a stamp to the way they treat financial advising, wealth management, and how they treat clients.

Frequently Asked Questions (FAQs):

1. What does the name “John Galt” mean to the company?

The name “John Galt” comes from Ayn Rand’s Atlas Shrugged, where John Galt represents innovation, individualism, and self-reliance. This name is, therefore chosen by the company to show commitment to empowering clients to take control over their financial futures through rational decision-making and independent thinking.

2. In what ways does John Galt Finance advocate for ethical money handling?

First, the firm, John Galt Finance, focuses on ethical practices where full transparency exists with clients. This includes clear communication about fees, investment strategies, and financial products. The ethics commitment by the firm is placed in its philosophy of putting the best interest of the client first and all the decisions taken to help align with long-term goals and financials.

3. What kind of clients does John Galt Finance usually serve?

The firm serves a broad spectrum of clients: individuals, families, businesses, and organizations. The company engages clients at various points in their lives-from young professionals who generate wealth to retirees in need of steady income flows. The concept is to help clients achieve financial self-sufficiency with personalized solutions.

4. Does the firm offer socially responsible investment at John Galt Finance?

Yes, John Galt Finance provides clients who want to steer their portfolio toward more social responsibility values with SRI options. The organization believes that profit and ethics can work together and tries through all means to give investors a chance at achieving financial objectives and personal values. This might include ESG investments.

5. What role does technology play in John Galt Finance’s operations?

John Galt Finance is using high technology to improve financial strategies. The firm uses data analytics, artificial intelligence, and algorithmic tools to optimize investment portfolios, minimize risks, and provide information in real time. By doing this, it can manage to give the most accurate, efficient, and personalized financial solutions.

Conclusion:

John Galt Finance embodies individualism, creativity, and integrity and offers a unique approach to wealth management, financial planning, and investment advisory services.

The firm, fueled by Ayn Rand’s John Galt philosophy that puts an eye on reason and long-term success, gives its clients control over their financial fates.

With such a full range of services, complete commitment to the practice of ethics, and use of cutting-edge technology, John Galt Finance is well-seated to help clients navigate modern financial landscapes while remaining true to personal responsibility and independence.

Whether you seek to build wealth, a retirement plan, or learn about personal finance in general, John Galt Finance is the place to go because it offers any tool and expertise necessary to be on the road to financial freedom.